In order to find a solution, We used the Design Thinking frame work

Kick off

We ran a CSD MATRIX that stands for Certainties, Assumptions and Doubts

The goal in here is to gather as much people with knowledge in the product you want to build or have information, then you cluster data and use knowledge to create hypothesis

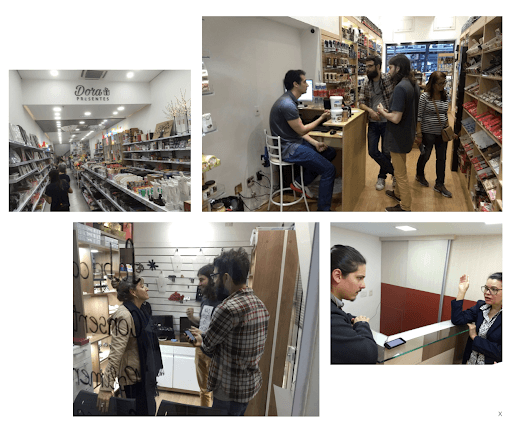

Recruiting merchants to interview

We talked to small businesses and conducted a questionnaire to understand the User Journey to find problems and needs regarding the current BNPL, the installments and settlement.

Research on merchant behavior

Buyer habits

The full price is never affordable for the majority of consumers in Brazil, their only concern with BNPL is whether the monthly amount is affordable, even if it takes years of monthly payments.

“The monthly charge needs to be affordable”

Seller habits

For the seller, knowing the amount in their bank account after a sale was a difficult task because of the fees, a mistake could lead to profit loss.

“If I charge R$ 1,000 in the BNPL method, split in 3 months, how much will I receive in my bank account and when?”

Defining the problem

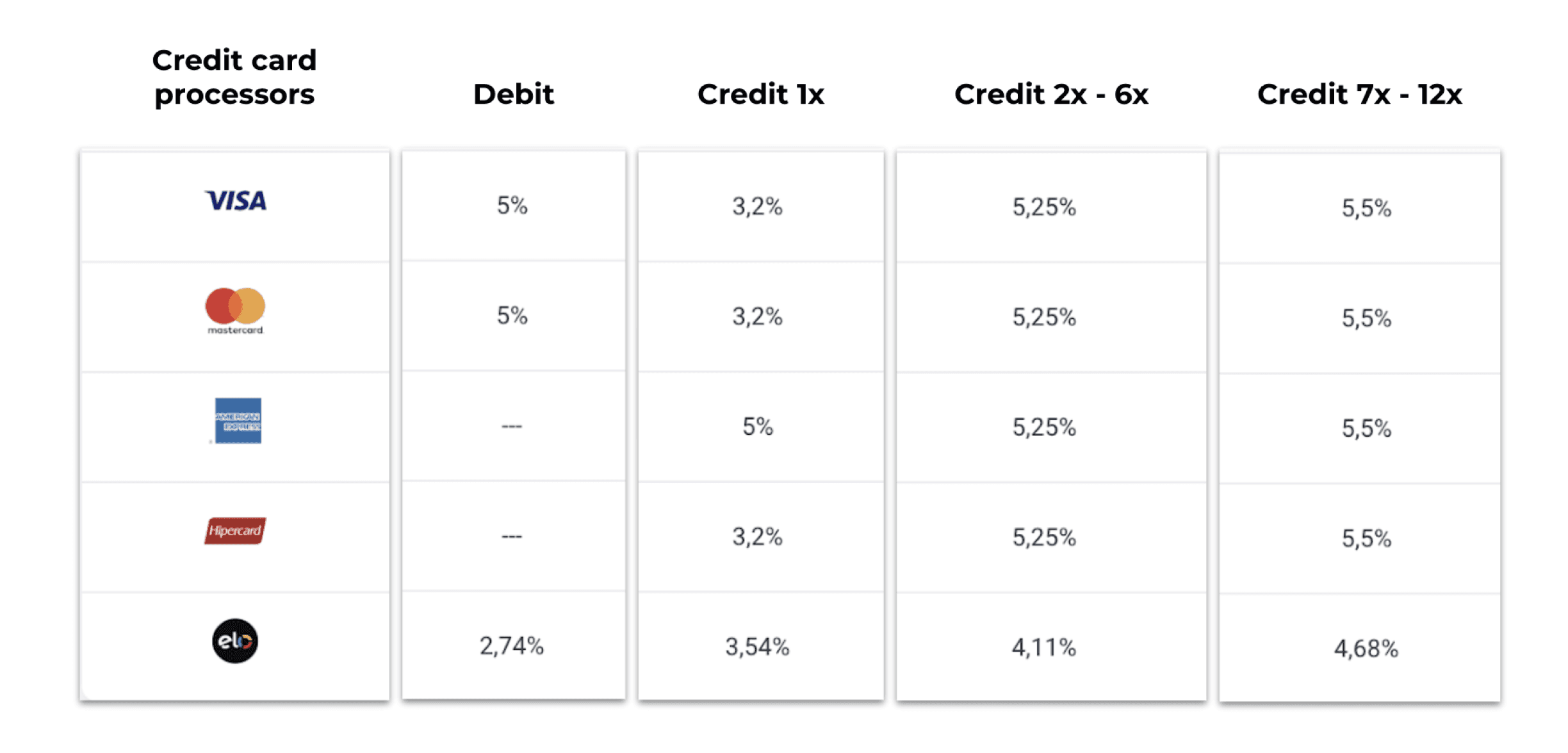

The math is complicated due to varying card fees, installment percentage ranges, and the anticipation fee dependent on the number of installments.

Business owner's life

• Cash flow

• Suppliers

• Inventory

• Contracts

• Government taxes

Merchants didn't want to add complexity in their workflow but needed the money to be anticipated, Brazilian people NEED the installment method to be able to afford expensive items, and the new bank solution would make Stone lose the anticipation fee to banks because of it was more simple to understand and apply without risk.

Defining Hypothesis

There were 2 questions that if we could make the business owner answer on their own, We should have the problem solved

🎯

TRANSPARENCY ISSUE

How much will I receive?

If I charge you R$100 using BNPL interest-free how much will I receive and when, what if I anticipate?

🎯

KNOWLEDGE ISSUE

How much do I need to charge?

How much do I need to charge this client for him to pay in 3 installments and I receive R$100 by tomorrow?

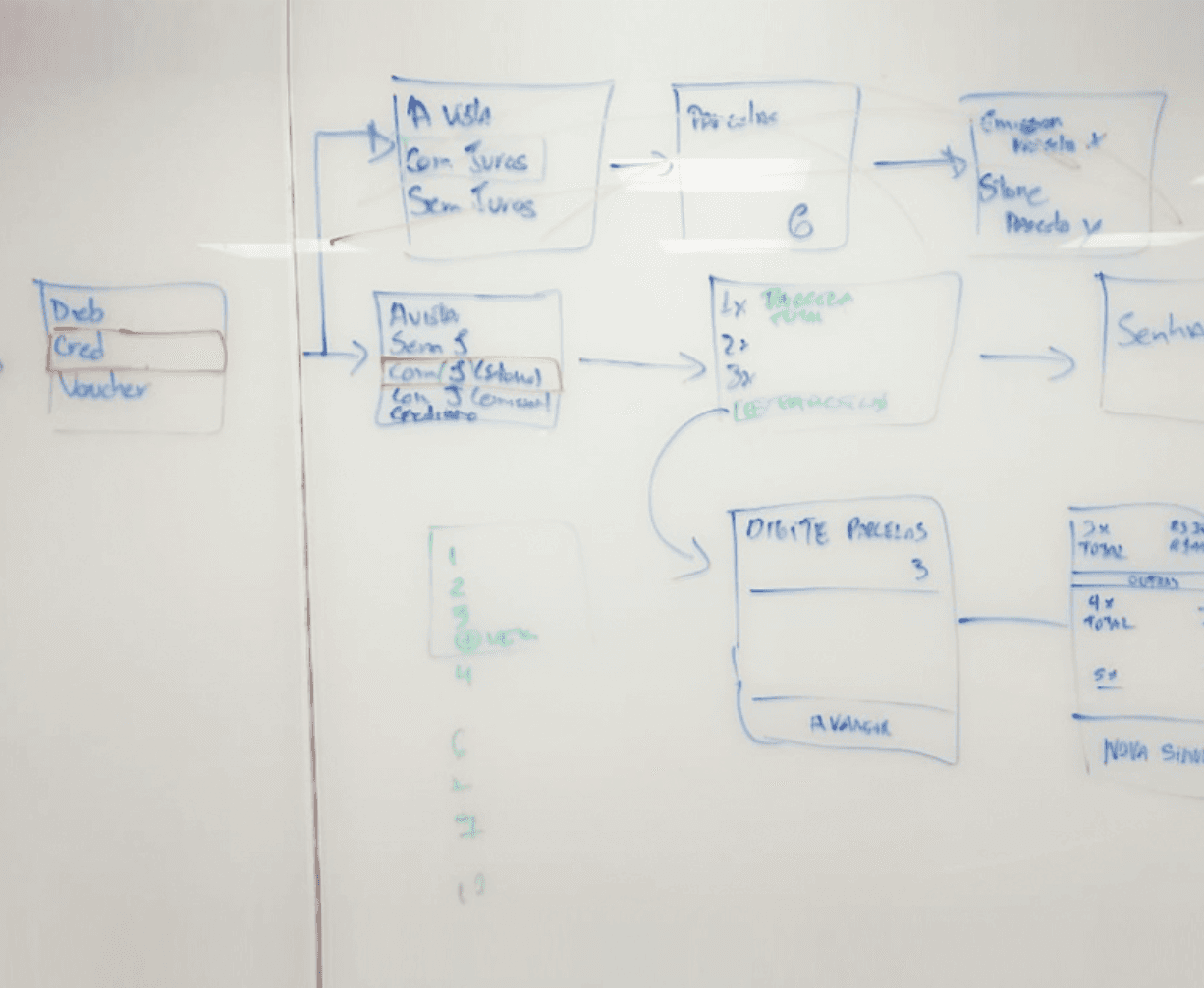

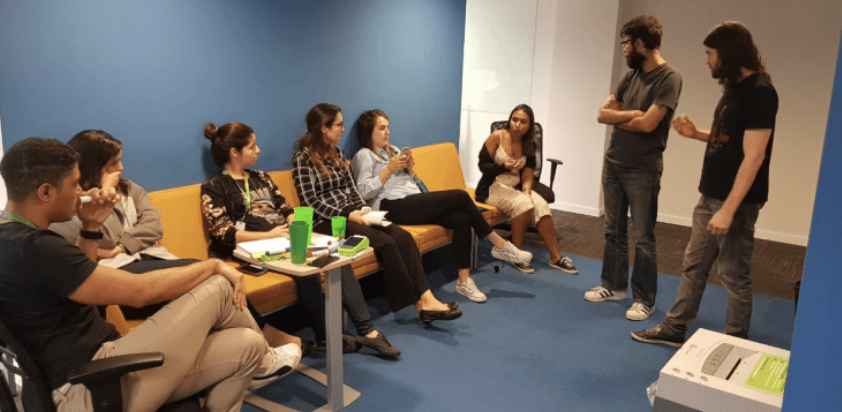

Ideation process

We assembled all relevant teams involved with the product, selected stakeholders, and collaborated to create the best flow to solve the problem.

7

Teams

The Solution

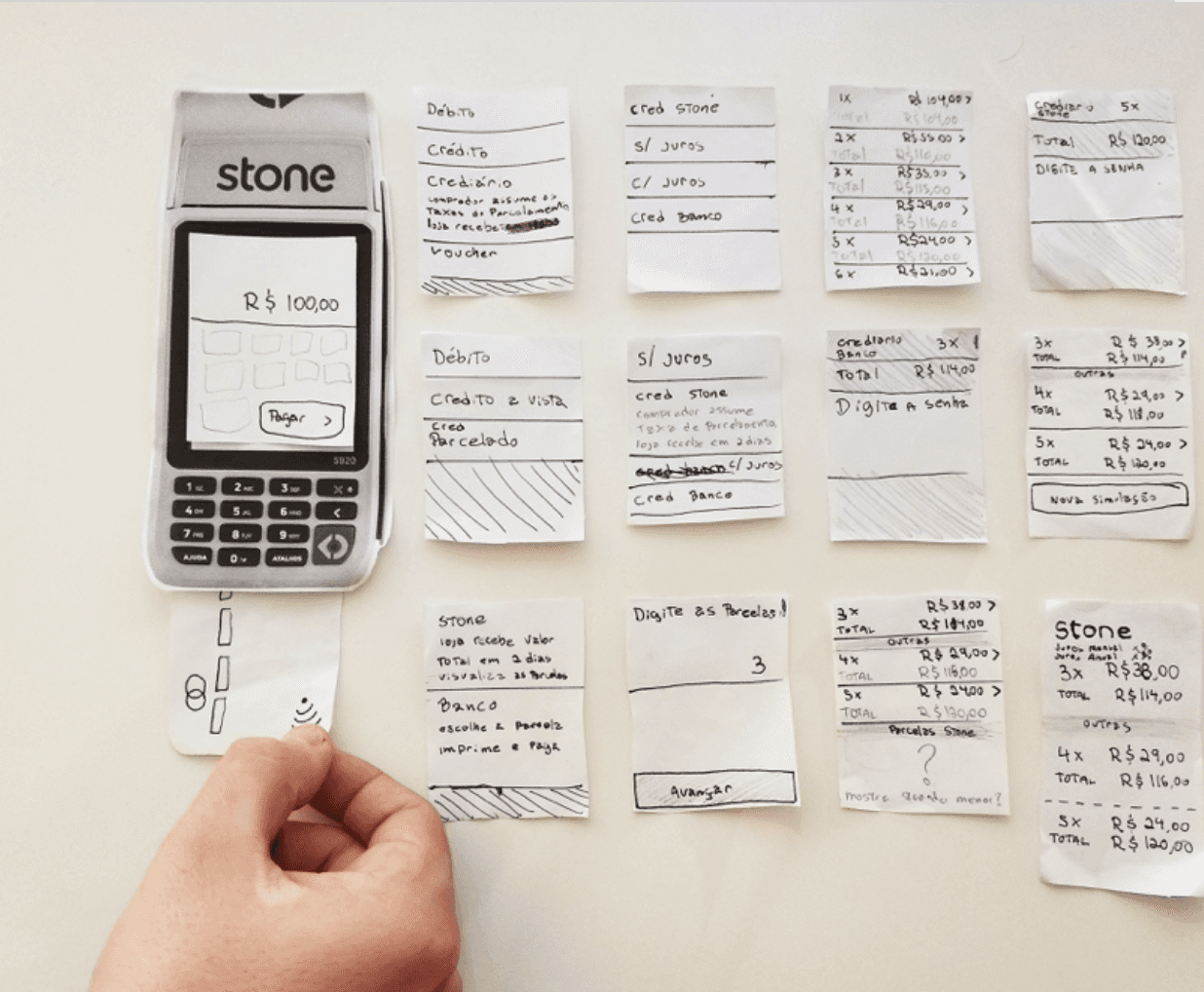

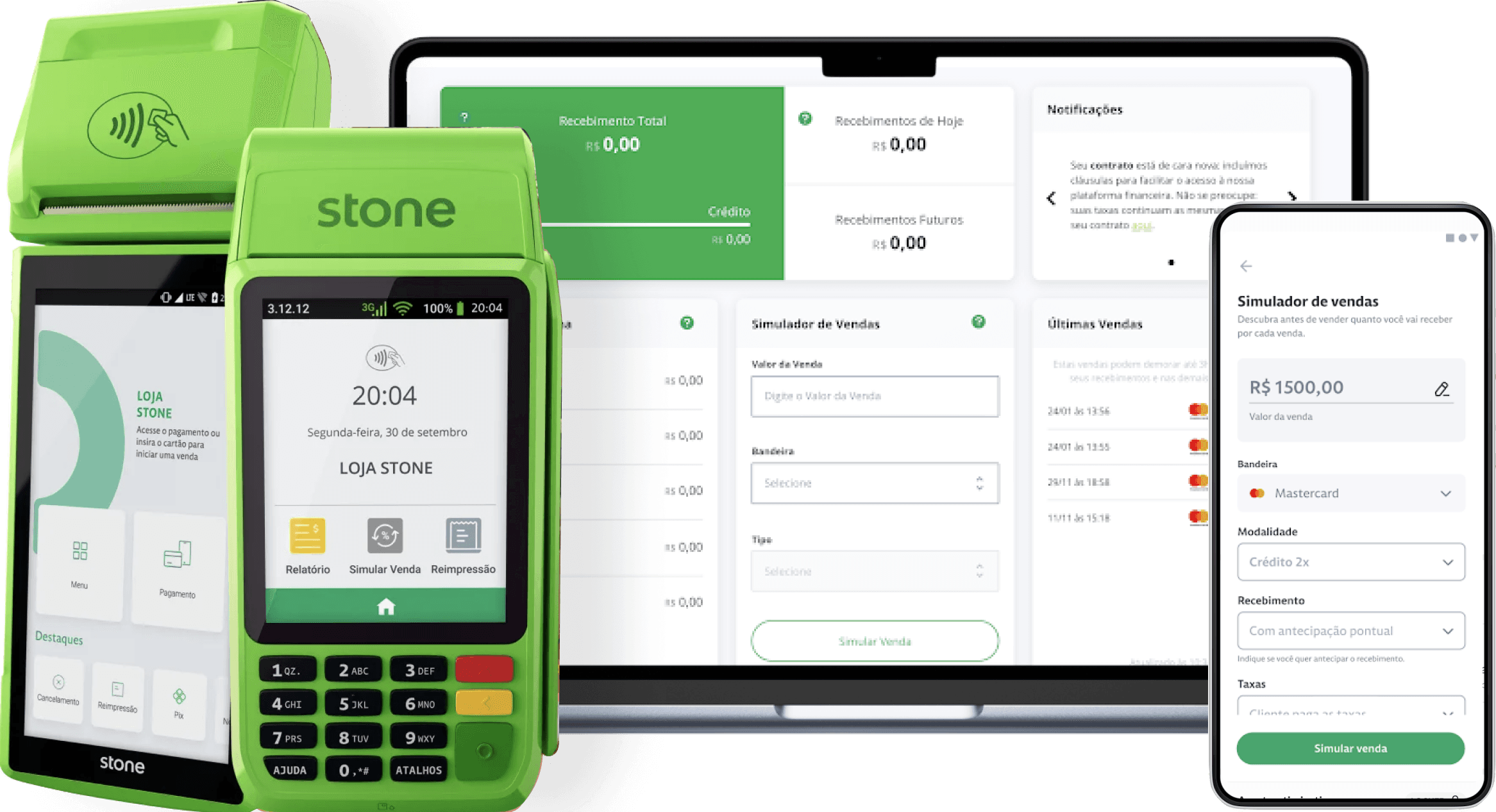

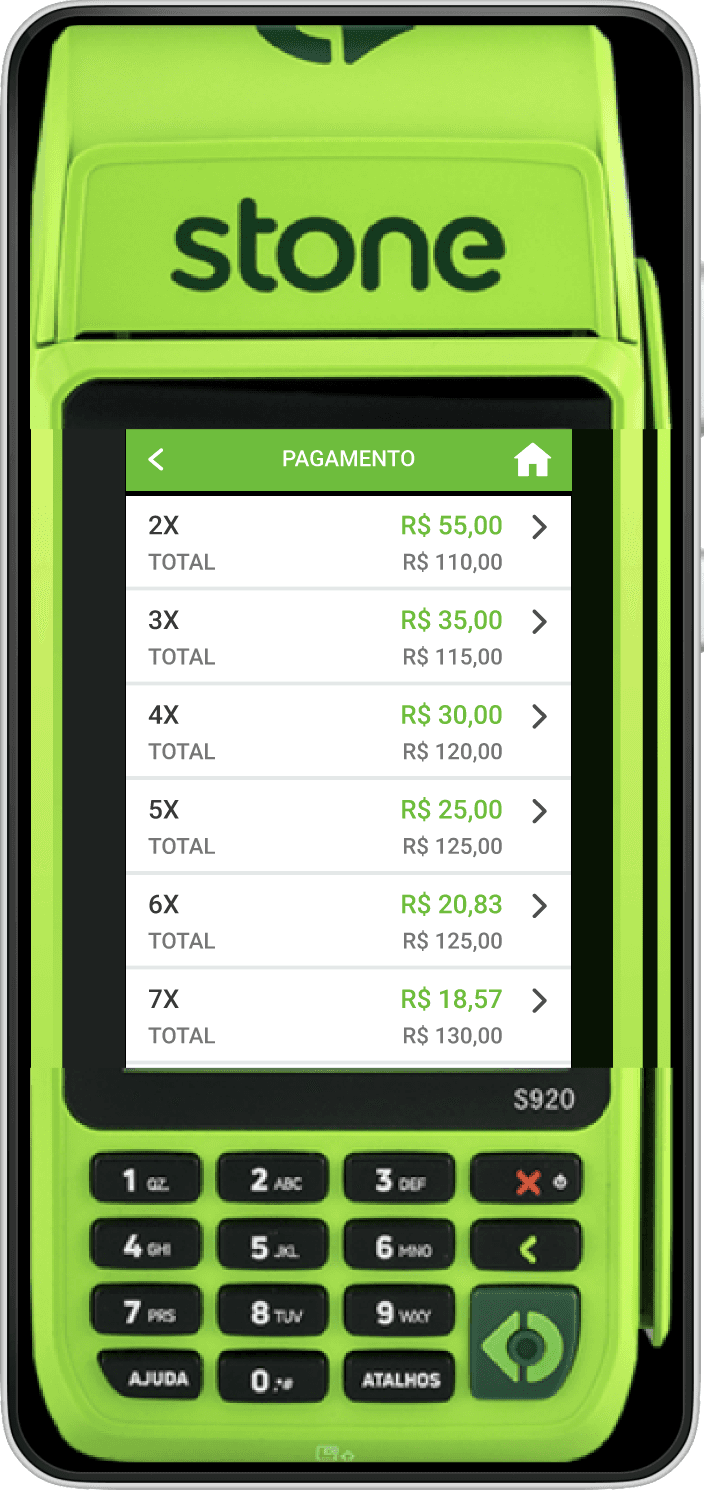

After observing sellers working with the interest-free installment(BNPL), we found that some used an Excel table to add the anticipation fee to the product price to fix the knowledge issue. So We created a sale simulator in the terminal to facilitate this process for other sellers, allowing them to input the necessary information to solve both issues.

🎯

Transparency: How much will I receive?

Knowledge: How much do I need to charge?

Prototyping for the machine

Low-fidelity prototypes were useful for testing within the team to validade quickly, with stakeholders, stone workers such as Developers and Customer Relations.

TOTAL

R$ 110,00

R$ 55,00

2X

TOTAL

R$ 115,00

R$ 35,00

3X

TOTAL

R$ 120,00

R$ 30,00

4X

TOTAL

R$ 125,00

R$ 25,00

5X

TOTAL

R$ 125,00

R$ 20,83

6X

TOTAL

R$ 130,00

R$ 18,57

7X

TOTAL

R$ 133,00

R$ 16,62

8X

TOTAL

R$ 136,00

R$ 15,11

9X

TOTAL

R$ 140,00

R$ 14,00

10X

TOTAL

R$ 143,00

R$ 13,00

11X

TOTAL

R$ 150,00

R$ 12,50

12X

pagamento

20:04

2.0.0

3G

70%

High fidelity

In 2018 prototyping on the real terminal was impossible due to development effort. At the time, the tool used for prototyping(InVision) didn't have scrollable frames with fixed top and bottom, so we moved to Figma to create an infinite border for the prototype. It worked on mobile with scrolling screens abstracting the idea of using a phone, achieving a testable prototype.

Feedback

Thank you

Back to main page

Let's chat

I'd love to learn about your project needs and see how I can help